A prop firm, or proprietary trading firm, is a specialized company that invests its own capital in the financial markets rather than managing funds on behalf of clients. In prop trading, firms recruit skilled traders to handle the firm’s funds, enabling these traders to participate in high-stakes trading with the support of the firm’s capital. Unlike traditional brokerage firms, where traders invest their own money, prop firms empower traders by providing access to larger sums, thus allowing them to take on bigger trades without risking their personal capital.

In recent years, prop trading has become a popular pathway for both beginner and professional traders to enhance their earnings while accessing a well-supported, risk-managed environment. In exchange, the profits generated are typically split between the trader and the firm, creating a mutually beneficial partnership. This setup allows prop firms to attract talented traders who might not have the capital to trade at a high level independently but possess the skills necessary for profitable trading.

Key Benefits of Using a Prop Firm for Traders

Prop firms offer several distinct advantages for traders at various stages of their careers:

-

Access to Substantial Capital: One of the primary benefits of joining a prop firm is access to significant capital, often far beyond what an individual trader could provide themselves. This capital enables traders to execute larger trades, which can lead to higher potential profits.

-

Reduced Personal Financial Risk: Since traders use the firm’s capital rather than their own, they avoid risking their personal funds. In situations where trades do not go as planned, the firm absorbs the financial loss rather than the trader. This arrangement creates an environment where traders can focus on skill development and strategy without the stress of personal financial loss.

-

Professional Development and Education: Many prop firms prioritize the growth and development of their traders, offering training sessions, mentorship, and valuable insights from market experts. These resources can be especially beneficial for beginner traders looking to enhance their skills and gain deeper market understanding.

-

Higher Earning Potential: By leveraging the prop firm’s capital, traders can aim for higher profits. The profit-sharing model also means that the better a trader performs, the more they earn. This structure incentivizes skillful trading and rewards expertise.

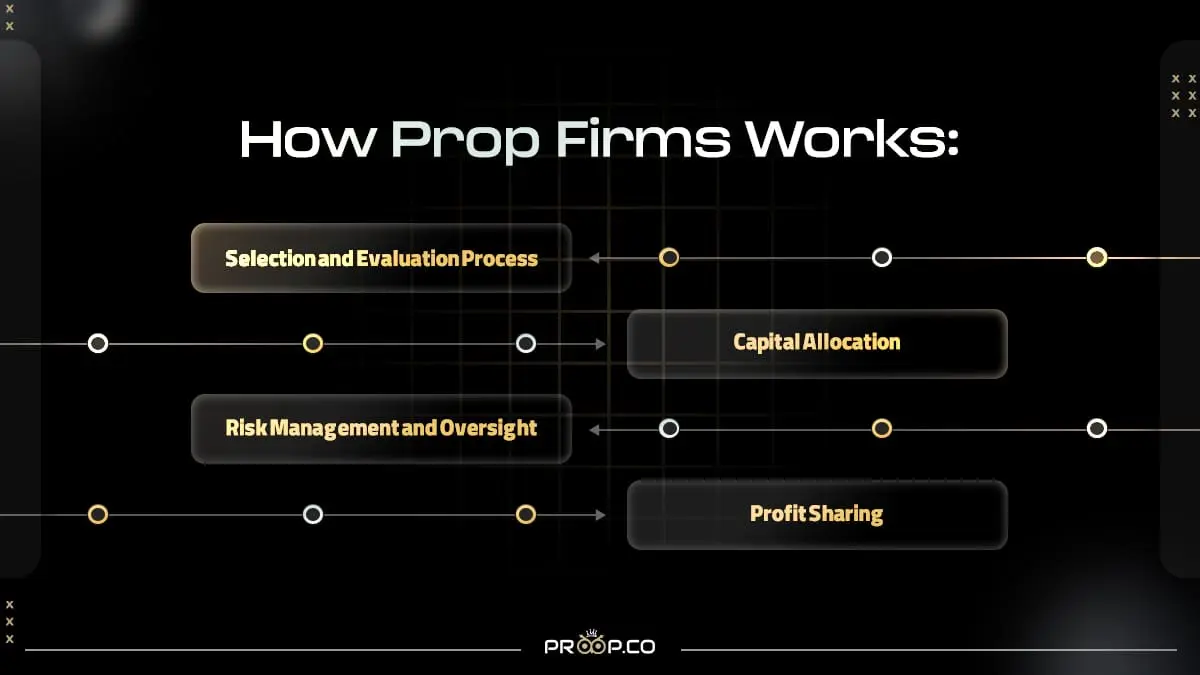

How Prop Firms Operate

Prop firms operate on a straightforward model: they provide capital and resources, and in return, they share in the profits generated by the traders they fund. Here’s a basic breakdown of how most prop firms function:

-

Selection and Evaluation Process: To join a prop firm, traders typically undergo an assessment process, often including simulated trading or real account challenges, to evaluate their skills, risk management abilities, and profitability. Firms use this process to select traders who demonstrate consistent, profitable performance.

-

Capital Allocation: Once approved, the trader is allocated a specific amount of capital to trade with. Depending on the firm’s policies and the trader’s performance, this amount may increase over time as the trader builds trust and demonstrates consistent success.

-

Risk Management and Oversight: Prop firms implement strict risk management protocols to protect their capital. This includes daily and weekly risk limits, guidelines on acceptable trading strategies, and close monitoring of each trader’s performance. Traders are expected to adhere to these guidelines to remain in good standing with the firm.

-

Profit Sharing Model: The profits generated from trading activities are split between the trader and the prop firm according to a pre-agreed percentage. This arrangement ensures that both parties are rewarded and incentivized, with successful traders often earning a higher share of the profits.

By understanding the structure and operation of prop firms, traders can make informed decisions about joining a firm that aligns with their career goals, risk tolerance, and trading style.

Features of a Top Prop Firm

Providing Sufficient Trading Capital

A top prop firm provides traders with access to substantial trading capital, enabling them to execute larger trades than they could on their own. This capital allows traders to fully leverage their skills and strategies in the market, without the limitations imposed by a smaller personal account. The amount of capital allocated to each trader often depends on their experience, risk management skills, and performance during the firm’s evaluation phase. Access to sufficient capital is essential as it allows traders to participate meaningfully in the markets and aim for higher profits without risking their own money.

Access to Advanced Trading Platforms

Leading prop firms offer traders access to advanced trading platforms that are both reliable and feature-rich. Popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader provide an array of tools for chart analysis, order management, and automated trading. Some firms may even provide proprietary platforms tailored to the needs of their traders. High-quality platforms are essential for effective trading, as they allow for fast execution, in-depth analysis, and access to real-time market data. Traders can optimize their performance by utilizing these advanced platforms and leveraging their features for informed decision-making.

Fair and Competitive Fees

A top prop firm maintains a fair and competitive fee structure. This includes reasonable costs for participating in evaluation challenges, withdrawal fees, and other service fees. Firms with excessive or hidden fees can significantly reduce a trader’s earnings, so transparency in fee structure is critical. The best prop firms aim to support traders’ profitability and growth by keeping costs minimal, enabling them to maximize their returns. It’s beneficial for traders to thoroughly understand a firm’s fee policies before committing to avoid unexpected costs.

Support and Training for Traders

Another key feature of a reputable prop firm is the support and training offered to traders. Many firms provide educational resources, webinars, mentorship, and one-on-one sessions with seasoned traders. For beginners, these resources can be invaluable, offering guidance on strategy development, risk management, and market analysis. For advanced traders, ongoing support can help refine existing skills and introduce new tactics that may enhance their trading results. The presence of a strong support system demonstrates the firm’s commitment to trader success and can be a decisive factor in selecting a prop firm.

Effective Risk Management Strategies

Risk management is central to the operation of any prop firm, as it protects both the firm’s capital and the trader’s potential earnings. Top prop firms enforce strict risk management rules, such as maximum daily loss limits, maximum position sizes, and guidelines for exposure in volatile markets. These policies are designed to prevent significant losses and ensure traders remain disciplined in their approach. Additionally, many firms offer real-time risk monitoring and support to help traders manage their positions. Effective risk management not only safeguards the firm’s assets but also fosters an environment where traders can make calculated decisions without the fear of catastrophic losses.

Advantages and Disadvantages of Prop Firms

Advantages of Prop Firms

One of the most attractive aspects of prop trading is that traders gain access to substantial trading capital without needing to invest their own money. This arrangement significantly lowers the financial barrier to entry, allowing talented traders to pursue profit opportunities they might not otherwise afford. By trading with the firm’s capital, traders can amplify their positions and potentially increase profits without bearing the risk associated with personal capital investment.

Professional Support and Training Programs

Many prop firms offer ongoing professional support, training, and mentorship programs. These resources can be instrumental, especially for beginner or intermediate traders looking to refine their skills. Through access to training programs and real-time feedback, traders can improve their strategies, learn advanced risk management techniques, and gain insights into market dynamics. This professional support not only aids in career development but also positions traders for long-term success within the firm.

Disadvantages of Prop Firms

Work Pressure and Performance Expectations

While prop firms provide capital and resources, they also come with high performance expectations. Traders may feel pressure to meet profit targets, adhere to risk limits, and consistently demonstrate profitable performance. This environment, though beneficial for driven individuals, can be stressful and demanding. Some firms may have strict rules regarding maximum drawdown or daily loss limits, and failure to comply can result in penalties or account suspension. Traders need to be prepared to manage this pressure while maintaining discipline in their trading.

Profit Split Considerations

In prop trading, profits are typically split between the trader and the firm. While this arrangement benefits both parties, it also means that traders do not retain 100% of their earnings. The percentage of the profit split varies by firm, with some firms offering a more favorable split (e.g., 80-90% to the trader), while others may retain a larger share. For traders, understanding the profit-sharing structure is essential to ensure that it aligns with their financial goals. Evaluating the firm’s profit split alongside other benefits can help determine if the arrangement is worth the shared earnings.

Choosing the Right Prop Firm

Analyzing Your Trading Needs and Objectives

Selecting the right prop firm begins with a clear understanding of your personal trading goals, style, and needs. Are you a day trader who requires high leverage and fast execution, or do you follow a longer-term strategy that emphasizes minimal risk? Each trader has unique requirements, and understanding these preferences is crucial when evaluating potential prop firms. For example, traders focused on building long-term strategies may prefer firms with lenient risk management policies, while high-frequency traders may prioritize access to advanced platforms with low latency.

Moreover, identifying your financial objectives is essential. If your main goal is to maximize short-term profits, firms with high profit splits and ample capital may be ideal. Conversely, if gaining experience and professional development is your priority, you may benefit more from firms that provide training and mentorship. Aligning your goals with the firm’s offerings can help ensure a positive and rewarding experience.

Evaluating Different Prop Firms Based on Key Criteria

Once you’ve clarified your trading needs, it’s time to assess prop firms based on specific criteria that directly impact your experience and success. Here are some key factors to consider:

-

Capital Allocation: Look for firms that offer adequate capital allocation, allowing you to scale your trades effectively without hitting capital limits prematurely. Many top firms increase capital over time based on performance, so consider whether this growth opportunity is available.

-

Fee Structure and Profit Split: Evaluate the cost of participating in evaluations, withdrawal fees, and any other hidden fees that might affect your net earnings. Additionally, ensure the profit split ratio aligns with your expectations, as this directly impacts your take-home pay from profitable trades.

-

Risk Management Policies: Each firm enforces its own risk management protocols, which could include daily loss limits, maximum position sizes, or restrictions on certain trading strategies. These rules are crucial for the firm’s security but must also fit with your trading style and risk tolerance.

-

Trading Platform and Tools: Make sure the firm supports a trading platform that suits your needs, whether it’s MetaTrader 4, cTrader, or a proprietary platform with specialized features. Access to advanced analytical tools, real-time data, and efficient order execution can significantly enhance your performance.

-

Support and Training: For traders seeking growth, choose firms that provide robust support and ongoing training. Firms that invest in trader education often lead to more successful, long-term careers and offer resources that can help you improve continuously.

-

Payout and Withdrawal Process: Check the firm’s policies regarding withdrawal frequency, minimum payout thresholds, and processing times. Reliable and timely payouts are essential for a stable trading experience and contribute to overall satisfaction.

Evaluating prop firms on these criteria allows you to make an informed decision, ultimately selecting a firm that not only supports your trading style but also aligns with your long-term goals. Careful consideration will help you avoid any misalignment in expectations and improve your chances of thriving within a prop firm environment.

Conclusion and Final Recommendations

In conclusion, prop trading offers a unique opportunity for traders to access substantial capital and professional resources, empowering them to maximize their potential in the financial markets without risking personal funds. By partnering with a reputable prop firm, traders can leverage high-quality platforms, benefit from expert training, and focus on skill development within a risk-managed environment. However, joining a prop firm also comes with performance expectations, profit-sharing arrangements, and sometimes intense pressure to meet specific targets.

For those considering prop trading, it’s essential to carefully assess your own trading needs, goals, and style before selecting a firm. Choosing a prop firm that aligns with your objectives requires evaluating factors like capital allocation, fee structures, profit splits, risk management policies, platform accessibility, and the level of support provided. Each of these aspects plays a crucial role in determining the success and satisfaction of your prop trading journey.

Final Recommendation: Take the time to research and compare multiple prop firms, understanding that each firm offers a unique combination of benefits and requirements. Prioritize firms that not only offer competitive profit splits and robust resources but also align with your trading goals and values. By finding the right match, you can set yourself up for a rewarding and potentially lucrative trading career with a prop firm.